South Tampa is a peninsula bordered by Bayshore Boulevard, the world’s longest continuous sidewalk, on the east and the Westshore District, Culbreath Isles, and Port Tampa on the west. This part of the city is lined with diverse neighborhoods, from new gated communities to older construction neighborhoods. If you are a homebuyer looking for a property that is near the water and is conveniently located near boutique shops and restaurants, South Tampa is definitely one of the best places to live in Tampa, Florida.

Property Taxes in Florida

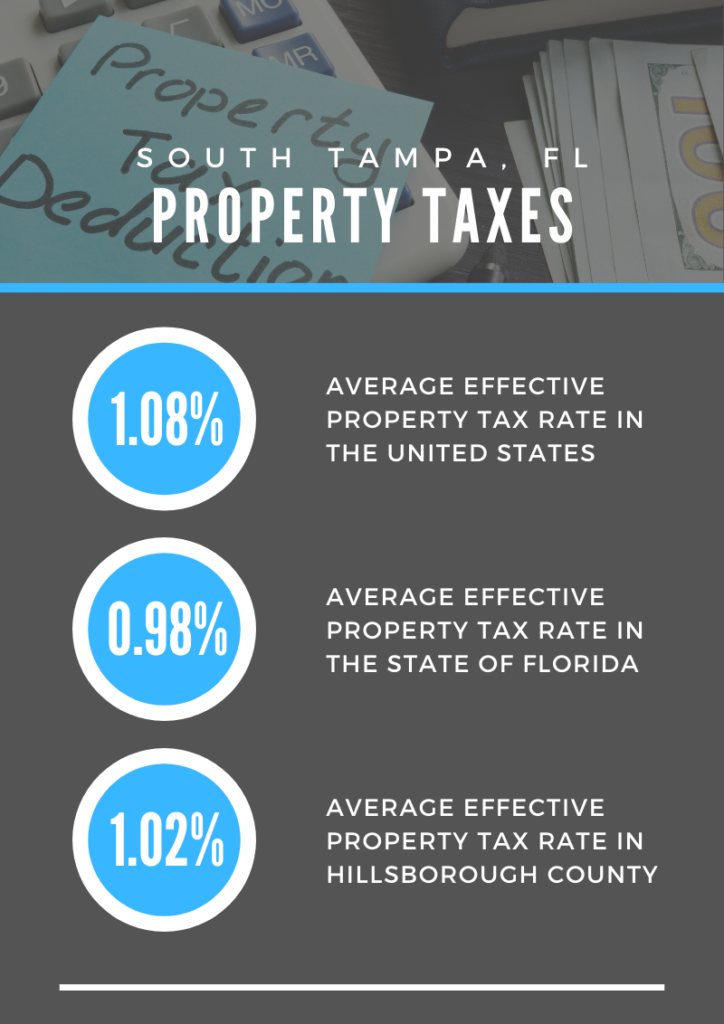

In the state of Florida, the average effective property tax rate is 0.98%, which ranks below the national average of 1.08%. The median annual property tax bill in the Sunshine State of $1,752 is also lower than the national median by over $300. There are laws in place that limit the taxes due on owner-occupied homes in the state. For example, the Save Our Homes assessment limitation caps increases in assessments for property taxes at 3% annually.

The first step in the Florida property tax process is property appraisal. Every county in the state has a property appraiser, who is an elected official responsible for the annual appraisal of every lot in their county. It is important to note that property tax rates are applied to the assessed value of a home, not its appraised value. Assessed value takes into account exemptions, including the Save Our Homes assessment limitation.

The most widely claimed exemption is the homestead exemption. Under this exemption, all legal residents of Florida can deduct $25,000 from the assessed value of their primary residence, reducing the taxable value of the property and their property tax. The homestead exemption is not granted automatically. For a homeowner to be eligible, you must take possession of the homestead by December 31 and then apply for exemption no later than March 31 of the following year.

Under Florida law, a residential property must be reassessed at market value when it is sold. Note that while a homebuyer may pay a pro-rated portion of the seller’s taxes at closing, the next year’s assessment will be at market value.

Property Taxes in Hillsborough County

South Tampa is governed by Hillsborough County, which has a population of more than 1.3 million people. The effective property tax rates in this county is higher than the Florida average mentioned earlier, at 1.02%. Consequently, the median annual property tax payment of Hillsborough County homeowners is also higher than the state and national medians, at $1,836. The median home value in this county is $179,500.

All residences with a homestead exemption are limited to a 3% per year cap on assessment increases. Note that when you purchase a home with a “capped” value, this will remain in effect only for the year of purchase.

Hillsborough County Appraiser and Taxing Authorities

The Hillsborough County Property Appraiser is an elected official who is responsible for appraising all the properties in the county, including real estate and tangible personal property, such as equipment, machinery, and fixtures, of businesses. The assessed value of real estate and tangible personal property is determined by the Property Appraiser. The primary mission at the Property Appraiser’s Office is to estimate fair and just values for all real and tangible properties in the county. Several factors influence the value of a property, and an important one is the amount that similar properties sell for on the open market.

On the other hand, taxes are levied by the taxing authorities. A Taxing Authority is a unit of government that determines tax rates and levies taxes. The Florida Constitution directly authorizes taxing authorities to levy ad valorem taxes.

Truth in Millage (Trim) Notices

A homeowner should receive their annual notice of property assessment (TRIM Notices) no later than the end of August. This document shows the estimated market value or “just value” of your property as of January 1. Just value, as defined by Florida Statute, takes into consideration the following factors:

- The present cash value

- The highest and best use of the property

- The location of the property

- The quantity or size of said property

- The cost of said property

- The condition of said property

- The income of said property

- The net proceeds of the sale of said property

When you receive your TRIM Notice, you will need to review it carefully. This document will show values and exemptions for both last year and the current year. Following the “Save Our Homes” Amendment 10 to the Florida Constitution. if you have an existing homestead exemption, any increase to your assessment will be limited to the Consumer Price Index increase or 3%, whichever is less.

Requesting for a Review

Florida law requires that properties be appraised at fair market value. If you believe that you could not sell your property for the market value indicated on your TRIM Notice, you may request a review.

The following information are required upon requesting for a review:

- Folio or Property Identification Number (PIN)

- Owner’s name

- Property address

- Your phone number(s) and best time to call, work or home

- Reason for review

You may use this link for searching your Folio or Property Identification Number (PIN).

There are five ways you may start a review. You may check this link to know which of the Property Appraiser’s offices are currently accepting walk-in customers. You may also mail your request to their downtown office. Reviews requested through mail are given the same priority as reviews requested by phone, e-mail, or fax.

Another option is to fax your request to the following:

- Real Estate Fax: 813-272-5519

- Tangible Property Fax: 813-301-7044

You may also contact their Customer Service hotlines below:

- Real Estate Review: 813-272-6100

- Tangible Property Review: 813-272-6988

Lastly, you may also request for a review by submitting a Property Value Review Request Form online. Once received, your request will be sent to the appropriate HCPA department for review and their team will contact you within 3-5 business days.

I hope this article has been helpful in providing you with information surrounding property taxes in South Tampa, Florida. If you have any further questions and are also interested to learn more about your home options in this lovely location, feel free to give me a call at (813) 789-2096 or email me at Realtor@EllenZusman.com.