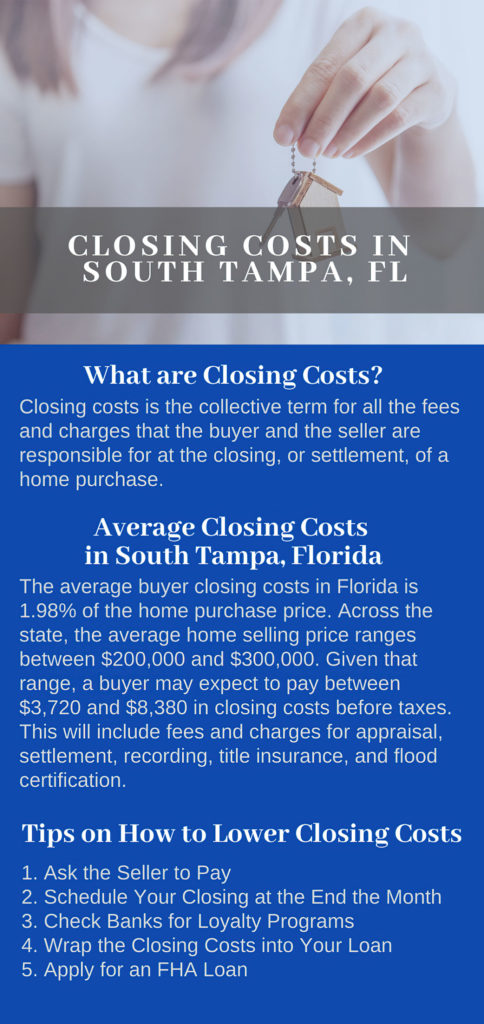

What are Closing Costs?

After a buyer’s real estate offer has been accepted by the seller, certain requirements need to be fulfilled by both parties. These requirements would entail fees and charges, and these are what we call closing costs. Some of these costs are assigned automatically to either the buyer or the seller; while others are dictated by local custom or negotiated by these parties. If you are in the market to buy a home in South Tampa, Florida, it is to your best interest to learn about these costs so you can get the best deal out of your real estate property purchase.

Average Closing Costs in South Tampa, FL

Average Closing Costs for Buyers

The average closing costs in Florida is approximately 1.98% of the home purchase price. While this may seem like an insignificant percentage, the amount a buyer has to pay may be quite high if the property being purchases is an expensive one. Across the state, the average home selling price ranges between $200,000 and $300,000. Give that range, a buyer may expect to pay between $3,720 and $8,380 in closing costs before taxes. This will include fees and charges for appraisal, settlement, recording, title insurance, and flood certification. A buyer will also have to pay for documentary stamps, which is a percentage of the sales price, as well as property and transfer taxes.

Average Closing Costs for Sellers

For Florida sellers, the average closing costs is around 1% to 3% of the total sales price, plus realtor fees which averages 6% and are also paid at closing. On the median home value in Florida of $229,000, the closing costs may range from $2,290 to $6,870 for sellers. For sellers who want to get a more accurate estimate of their closing costs, multiply the sales price of the home being sold by 3%.

Breakdown of Closing Costs in South Tampa, Florida

Typical Closing Costs for Florida Homebuyers

The closing costs for buyers are generally more focused on the financing aspect of the deal, these would be significantly less if the buyer is paying for the house in cash. Here are the typical buyer closing costs in Florida:

- Appraisal Fee (If Financing)

- Credit Report Fees

- Financing Fees (e.g., Loan Origination Fee)

- Home Inspection Fee (Generally Paid Before Closing)

- Lender’s Title Insurance (If Financing)

- Settlement Fee

- Survey Fee

- Title Search Fee

Typical Closing Costs for Florida Sellers

The closing costs for sellers are slightly different compared to those of homebuyers. However, take note that a lot of closing costs are negotiable, so these can vary significantly between transactions. Here are the typical seller closing costs in Florida:

- Miscellaneous Costs

- Mortgage Payoff

- Prepayment Penalty

- Recording Fees

- Settlement Fee

- Title Insurance

- Title Search

- Transfer Tax

How Can a Tampa Homebuyer Lower Their Closing Costs?

If you are a first-time homebuyer in South Tampa, Florida, reading through the list of closing costs can be quite overwhelming, but keep in mind that most of these are negotiable and that there are a few more things you can do to lower your overall closing costs:

1. Bank Loyalty Programs

Certain banks offer incentives or rewards to their customers for choosing to finance their home purchase with them. One example of such bank is Bank of America, which offers lower origination fees for “Preferred Rewards” members. So, do your own research and see which bank would provide you with the best assistance.

2. Set Your Closing Date at Month End

Why would your closing date affect your closing costs? This is related to your prepaid or “per diem” interest. Scheduling your closing date can help reduce your cash outlay because the number of days from your loan closing and the start of the following month is less compared to when your closing date scheduled earlier in the month. If you multiply your loan amount by your interest rate then divide the result by 365, you will get your interest charge per day. Multiply this by the days left in the month and you will get the amount that you will have to pay at closing. So, in effect, the lesser the number of days would result to lower interest.

3. Negotiate with the Seller

As mentioned earlier, closing costs are not set in stone and there are certain expenses that homebuyers can negotiate with the seller. Most lenders allow sellers to contribute up to 6% of the home purchase price as a closing-cost credit. This is a strategy to help them seal the deal and is also a tax-deductible expense for the seller.

4. Wrap the Closing Costs into Your Loan

At first glance, this might not seem like a good option to lower your overall closing costs because mortgage lenders would be charging you more for this. However, this would be a good move if you happen to have not enough cash on hand to pay for your closing costs. Another thing you may also want to consider is a no-closing-cost mortgage wherein the lender covers the fees. If you do choose this route, be prepared to pay a higher interest rate for the duration of the loan, which also translates to larger mortgage payments.

5. Apply for an FHA Loan

An FHA (Federal Housing Administration) loan is a government-backed mortgage which is available to those who have lower incomes. Once approved, you may benefit from the help of various third parties, such as real estate agents, sellers, and mortgage brokers, who can pay up to 6% of the new loan amount. Relative to traditional lenders, FHA loans are not as strict on credit scores and borrowers who have a credit score of 580 or higher are likely to qualify.

If you are currently in search of a lovely home in South Tampa, Florida, I would gladly show you all your best options and assist you in every stage of your home purchase transaction. Please give me a call at (813) 789-2096 or send me an email at Realtor@EllenZusman.com for any questions or if you want to schedule a meeting.

Closing Costs in South Tampa, Florida Related Information

Old West Tampa – Midtown

Parkland Estates

Golf View

Beach Park Isles

South Tampa Neighborhoods

New Suburb Beautiful

Belmar Gardens

Bayshore Gardens

Palma Ceia West

Virginia Park